The Best Guide To Best Financial Planners Melbourne

Table of ContentsWhat Does Finance Brokers Melbourne Mean?A Biased View of Best Financial Planner MelbourneSome Known Factual Statements About Best Financial Planner Melbourne Finance Brokers Melbourne - QuestionsSome Ideas on Melbourne Finance Broker You Should Know

The mortgage brokers are primarily controlled by the Singapore Legislation of Company. A research study carried out by Chan & Partners Consulting Team (CPCG) reveals that the home loan brokering industry is still largely a new principle to the Singapore economic customers. Home loan brokers in the nation do not bill debtors any kind of cost, instead revenues are made when the monetary institutions pay the broker a compensation upon successful lending disbursement via the broker's referral.Let's be clear. When we state "preparing to talk with a mortgage broker" you practically don't need to prepare a thing. Consider it much more like a casual (and exciting) chat. In claiming that, it's handy to have a few points in mind so you can obtain the most out of your conversation.

What are my goals outside of residential property? What are my non-negotiables in a property? There's no obligation to prepare inquiries, of course.

The 8-Minute Rule for Best Financial Planner Melbourne

At Finspo, we have over 30! Structure assessor. These are all people you can have on your side a broker can describe what they do, when to call on them and exactly how they fit right into your team.

The 9-Minute Rule for Melbourne Finance Broker

However hey, we won't go tooooo deep at this stage. Oh, sorry, that's simply Luke. Of all, make certain you leave the conference feeling good recognizing you've started the discussion that a lot of people commonly discover complicated. After that, what happens next is entirely up to YOU. With Finspo, you can move as quick or slow-moving as you such as.

Be careful of approximated supplied by your home mortgage broker that they have been provided by the lending institution. Quotes are not legitimately binding and it is very important to totally recognize the real home mortgage terms prior to finalizing. If you already have a lengthy and favorable partnership with solid connection with a financial institution, you may be able to get a lot straight from a finance officer at the financial institution.

Get This Report about Melbourne Finance Broking

With a lot of bargains from a range of loan providers, mortgage brokers have the capacity to go shopping around however knowing a commitment offers from your own bank makes feeling. Home loan brokers are fantastic at going shopping about for the very best deals but the truth is that some major banks prefer not to do service with exterior brokers.

Right here are some methods you can select the best broker to work with: Request for referrals from family members, good friends, or your property representative Inspect their qualifications and specialist associations Explore online customer reviews Verify their charges and commissions.

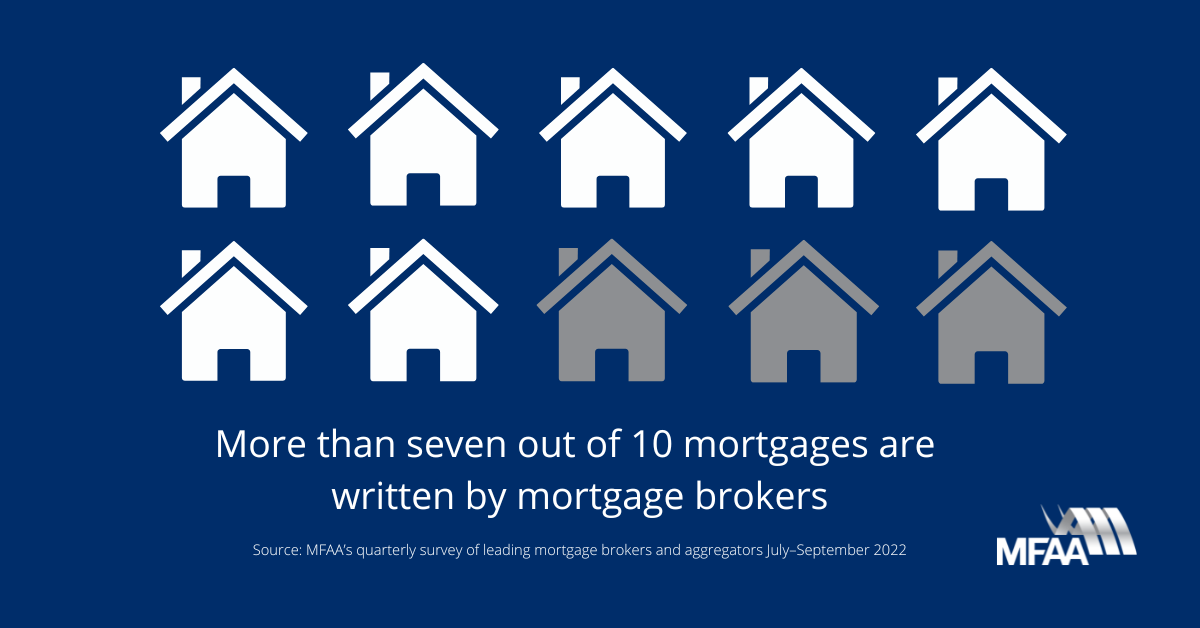

When it comes to taking out a home finance, Australian consumers aren't doing not have in options. There are well over 100 banks and various other lenders currently operating on the market offering thousands of various mortgage products.

A Biased View of Melbourne Finance Broking

Instead of someone going right to the financial institution to get a car loan, they can go to a mortgage broker that will have accessibility to a lot of different lenders - quite usually a panel of as much as 30 various loan providers."The first thing they truly do is evaluate a client's demands, due to the fact that every person's going to be various.

With a broker, you may be missing out on out on a specific sub-sector of the loaning market that can commonly have the finest offers."That's not to state that brokers can't help their clients save money on their home loan in other methods.